In a new series, readers ask our new columnist, Nicola Barber, a series of questions relating to investment and trusteeship.

Nicola has over 35 years of investment experience, including working as an independent trustee for a UK family trust and a trustee director for the pension scheme of the Citizens Advice Bureau. She joined James Hambro & Partners in early 2012 and is an experienced equity investor and portfolio manager specialising in managing portfolios for larger and more complex clients. Nicola chairs the firm’s Corporate Social Responsibility (CSR) and Responsible Investment Committees which are integral to the firm’s culture and management of client portfolios respectively. She supports charities through dedicated trustee training and writes and presents widely. Nicola is an active member of the CFA Institute

---------------------------------------------------------------------------------------------------------

Question: “Do you think charities should prioritise investments over cash reserves?”

Answer: The quick answer is that they are not mutually exclusive. Trustees should develop policies for both reserves and investments, the differentiating feature is typically the time horizon, and they are both important elements of resource planning and sound financial management. They are also key issues for the Charity Commission.

The interplay between them varies depending on the nature of the charity. However, cash flow is critical to the sound day-to-day management and reserves need to be readily available to address unforeseen circumstances. An investment strategy, utilising anything other than cash, introduces risk and has the potential to deliver negative returns; remember 2022 when UK bonds, historically a defensive asset, fell -25%.

Let’s explore both in more detail. A reserves policy should be tailored to a charity’s circumstances, identify and plan for maintenance of essential services for beneficiaries, reflect the risks of unplanned closure and consider spending commitments, potential liabilities and financial forecasts. It is typically shorter term in nature than an investment policy and regularly appraises its effectiveness given changing funding and financial environments. It provides confidence to funders, lenders and creditors, demonstrates resilience, and protects a charity’s reputation.

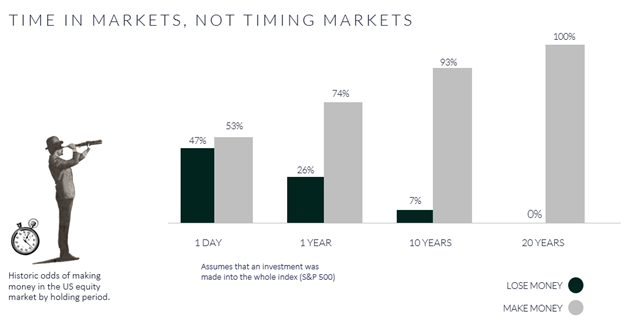

An investment policy can focus on short, medium and longer-term time periods depending on cash withdrawal requirements. A charity I look after has three strategic mandates depending on likely project commitments – conservative (40% equity weight), balanced (55%) and steady growth (70%). Importantly, trustees should consider risk (volatility) of the portfolio. An investment policy that utilises a high proportion of equities to potentially enhance returns typically invests for the long term to avoid withdrawals at unexpected times when markets may have fallen. The diagram below demonstrates this point.

Source: Brian Feroldi, S&P 500 Returns. Assumes that an investment was made into the whole index (S&P 500).

Past performance is not a reliable indicator of future performance. The value of investments, and the income from them, may go down as well as up, so you could get back less than you invested.

Bringing cash reserves and investments together provides for an interesting dynamic. The importance of one over the other depends on factors including, but not limited to, new projects, budgets, risk management, funding streams and other sources of income.

Strong governance foundations are essential to the success of any charity. Strategic planning in areas such as reserves and investments should be proportional for the size of the organisation and reviewed regularly. Setting a policy for reserves first, that is specific to the needs of the charity and set not too high or too low, will allow for surplus funds beyond this to be invested with associated higher levels of risk for potentially longer time periods. Unfortunately, there is not a one size fits all.

Latest News

-

Mental health charity staff announce further strike days

-

Regulator concludes case into anti-extremism charity

-

Friday funding round-up: 23 January

-

Career path: From the corporate world to charity CEO

-

Young women key to future of mass participation fundraising, survey suggests

-

Government launches £11.5m Civil Society Covenant fund

Charity Times video Q&A: In conversation with Hilda Hayo, CEO of Dementia UK

Charity Times editor, Lauren Weymouth, is joined by Dementia UK CEO, Hilda Hayo to discuss why the charity receives such high workplace satisfaction results, what a positive working culture looks like and the importance of lived experience among staff. The pair talk about challenges facing the charity, the impact felt by the pandemic and how it's striving to overcome obstacles and continue to be a highly impactful organisation for anybody affected by dementia.

Charity Times Awards 2023

Mitigating risk and reducing claims

The cost-of-living crisis is impacting charities in a number of ways, including the risks they take. Endsleigh Insurance’s* senior risk management consultant Scott Crichton joins Charity Times to discuss the ramifications of prioritising certain types of risk over others, the financial implications risk can have if not managed properly, and tips for charities to help manage those risks.

* Coming soon… Howden, the new name for Endsleigh.

* Coming soon… Howden, the new name for Endsleigh.

Better Society

© 2021 Perspective Publishing Privacy & Cookies

.jpg)

Recent Stories